When you buy a property or land, you will have to pay Stamp Duty (SDLT). This is a tax that is paid to the government, but how much you will pay depends on a number of factors and we have looked at some of these for you.

Stamp Duty in the UK

There are different rules applied to paying stamp duty in the United Kingdom depending on which country you live in. England and Northern Ireland follow the same rules, while Wales and Scotland have different rules. In England and Northern Ireland from 1st October 2021, you won’t pay stamp duty on properties under £125,000. Manchester, for example, has many properties that come into the band of £125,00 – £250, 000, and this band will incur a stamp duty of 2%. Over that amount it increases in stages. For those needing a home buyers survey Manchester has many excellent providers.

If you are a first-time buyer, there is a first-time buyer’s stamp duty tax relief, which means that the stamp duty is waived on properties under £300,000.

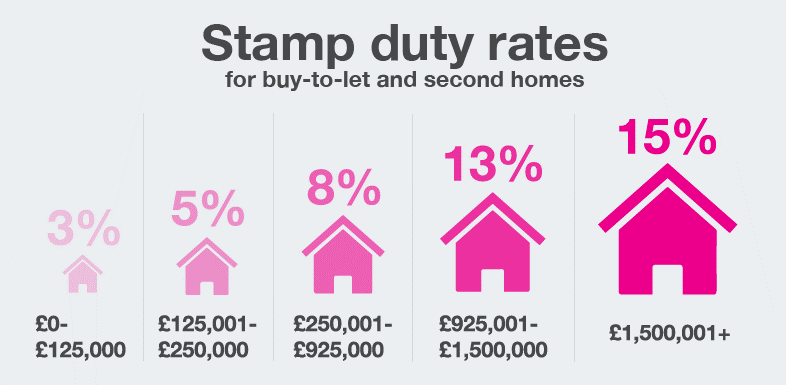

There are different rules too if you are buying another property or for a buy-to-let investment, for example. A conveyancing firm such as https://www.samconveyancing.co.uk/Homebuyers-Survey/home-buyers-survey-birmingham will be able to advise you further about your options..

How Is It Calculated?

Before you go ahead with searching for a property and thinking about your budget, it is a good idea to consider how much stamp duty you will have to pay. There are some online calculators that will do this calculation for you. This will give you some idea for your total budget, and your conveyancer or solicitor will give you the final amount you would be expected to pay.

How Is It Paid?

Your solicitor will advise you on how much stamp duty your circumstances and the property will incur. They will be handling this aspect of the purchase for you, and the stamp duty has to be paid within two weeks of the sale going through.

Stamp duty is another bill that needs to be considered when purchasing property or land. Your solicitor or conveyancer will pay this on your behalf, but it is a good idea to get a quote on the amount you will be expected to pay when considering buying a property.

Average Rating